The way Americans fund their retirement has undergone a fundamental transformation in the last 30 years. According to the Bureau of Labor Statistics, the percentage of private-sector employees with a traditional defined benefit pension plan has dropped from about 45% in 1980 to a little over 20% in 2011. A defined benefit pension plan is one that provides the retiree with a guaranteed income for the rest of his or her life.

The guaranteed pension has been replaced by a defined contribution plan. Today, about 50% of the private workforce participates in one of these plans, which include 401(k) plans and 403(b) plans and allow the worker to set money from their paycheck aside to grow tax-deferred until they retire, at which point they can start pulling from it to fund their retirement. However, there is no guarantee that the amount saved will be adequate to meet their income needs once they retire.

Most government workers still have access to traditional defined benefit pension plans. However, most of these plans are severely underfunded and questions are being raised about cities and states being able to pay the benefits that were promised. A recent poll of people 25 years and older concluded that “Americans are united in their anxiety about their economic security in retirement.” Over 75% of those surveyed worry that economic conditions might hurt their chances for a secure retirement. (For related reading from this author, see: How Retirees Should Think About Retirement Income.)

Social Security and Medicare Concerns

The federal government provides a basic level of retirement income via Social Security, and provides a basic level of health insurance via Medicare and Medicaid. However, these programs are on shaky ground according to most actuaries. The Social Security Trust Fund will run out of money around 2034 unless it is reformed. That does not mean that checks will not go out to retirees, but it does mean that the amount going out will decrease.

Medicare is in even worse shape and, with the continued rapid rise in medical costs, may face a crisis even sooner. The costs of health care and increasing life spans are major issues for retirees, which explains the reason that so many Americans think they are facing a retirement crisis in the first place. Given the level of debt at the federal level and the rhetoric of the current administration, we do not see the government jumping in to fund the American worker’s retirement at levels above what it does now.

Even Denmark, an icon of the Welfare State, is proposing tax cuts, reducing welfare benefits and raising the retirement age.

“We want to promote a society in which it is easier to support yourself and your family before you hand over a large share of your income to fund the costs of society.”

Funding Your Own Retirement

If the government is not going to come to the rescue, and if corporations are going to continue to unload the financial risks and burdens associated with pension plans, what is the answer? Look to the old saying, “If you want something done, do it yourself.” Going forward, it’s increasingly going to be up to the individual American worker to fund his or her own retirement.

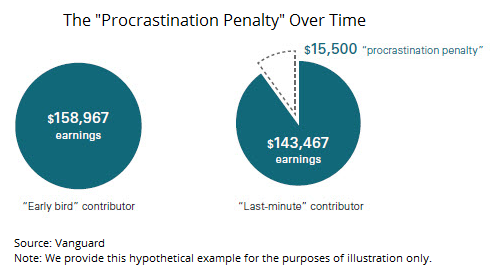

If people begin saving early, a large part of the retirement problem will be solved. The most valuable asset that people have when they are young is time. If workers begin putting money aside at an early age, it will grow and compound for 40 to 50 years until retirement, solving a large part of the problem. The compounding of returns is what makes so much of the difference.

Here is a little math exercise: assume you begin by saving $25 per month—much less than the cost of having one decent dinner at a restaurant—and invest it conservatively so that it grows at 5% per year. At the end of 45 years you will have $50,000. Now assume that you increase your savings by 10% each year—so that in year two you save $27.50 per month (still far less than the cost of just one dinner out)—at the end of 45 years you have $400,000 to use in retirement. These examples go to show that saving a modest sum for retirement does not require much cost or effort, just discipline, time and patience.

Financial Education is Key

The greatest asset that young workers have is time. Unfortunately, people rarely enter the workforce knowing much about saving or investing. That is one reason so many people live paycheck to paycheck. The solution to the retirement crisis is achievable by educating young people and raising awareness. Until schools and colleges begin having mandatory courses for our young people about managing money, parents should be doing this. If they are unsure, they can put their children in touch with a financial planner who will spend time to provide the education. Many financial planners are beginning to offer hourly rates to help people learn to plan and budget.

For most people, the retirement problem is the result of a lack of information. The solution is right in front of us, if we realize that times have changed and people must change with it.

(For more from this author, see: Are You Ready for the Retirement Challenge?)